Ways To Give

PRESERVING THE PAST FOR THE FUTURE

How You Can Make a Donation and a Difference

Did you know you can help the museum by simply shopping? Or, that individuals age 70½ or older can make a qualified charitable distribution (QCD) directly from their IRA to a qualified 501(c)3 organization? And that QCD’s can be used to satisfy IRA-required minimum distributions (RMD) for individuals age 73 or older?

The Kaysville Fruit Heights Museum of History and Art is a registered 501 (c) (3) corporation so your donation is tax deductible. If you would like a receipt for your tax records, please note it with your contact information. Thank you for all you do to help preserve our history.

This program makes donating easy. Just link your rewards card to Kaysville Fruit Heights Museum (EY229), and all you have to do is shop at Smith’s and swipe your card. Smith’s will donate a portion of the eligible purchase price at no additional cost.

(Smith’s logon required)

Do you Venmo? If yes, we can be found on Venmo Fawn Morgan @KFHMha.

Do you Venmo? If yes, we can be found on Venmo Fawn Morgan @KFHMha.

Or simply scan the QR Code and find us that way.

Would you like a charitable donation receipt? Be sure to include your Name, address, phone number, and email.

Thank You.

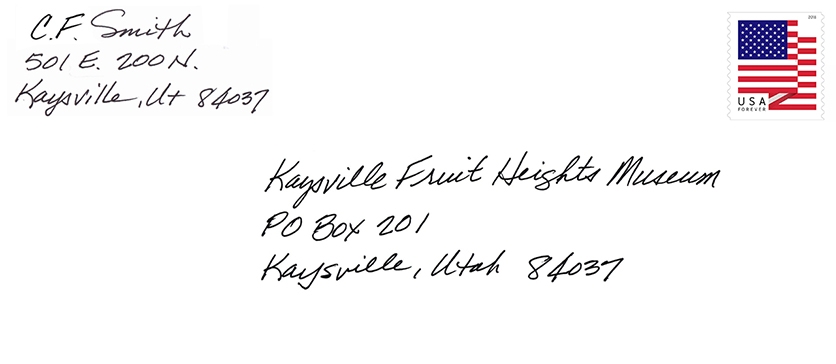

GIVE BY MAIL

Make checks payable to:

Kaysville – Fruit Heights Museum.

Send to:

Kaysville-Fruit Heights Museum

PO Box 201, Kaysville UT 84037-0201

Please indicate if you would like a receipt for your tax records – include Name, address, phone number, and email.

Thank you.

GIVE AT ZIONS BANK

You can make a donation at any Zions Bank branch. Simply let the teller know you are making a donation to the Kaysville Fruit Heights Museum.

Please be sure to leave your contact information with the teller and a notation if you would like us to provide a charitable donation receipt.

Make a Gift Tax-Free With an IRA

A Tax-Saving Way to Help the Kaysville Fruit Heights Museum of History & Art

Your IRA can provide a tax-smart way to make an impact with Kaysville Fruit Heights Museum of History & Art now. The Qualified Charitable Distribution or QCD is a great way to make a tax-free gift and satisfy your Required Minimum Distribution (RMD), too.

How Do I Qualify?

-

- You must be 70½ years or older at the time of the gift.

- Gifts must transfer directly from your IRA

- Gifts cannot exceed $100,000 per donor per year

Benefits of Qualified Charitable Distribution

-

- If you don’t itemize your income tax deductions, a QCD offers all of the benefits of an itemized income tax charitable deduction

- If you are age 73 or older and must take a Required Minimum Distribution RMD, a QCD gift can satisfy your RMD without increasing your income taxes.

- You may direct your gift to a program or area of your choice.

- It is a wonderful way to create an immediate impact

How Can I Make an IRA Charitable Rollover?

Contact your IRA administrator to request a Qualified Charitable Distribution from your IRA to Kaysville Fruit Heights Museum of History and Art.